The 20th ITR Global Transfer Pricing Forum USA is going virtual

The ITR Global Transfer Pricing Forum - USA 2020 is now a virtual event on December 1 & 2. Attracting over 400 attendees, tax and transfer pricing professionals will come together online to gain critical insight and advice on key TP issues facing today's taxpayers operating in the US.

Key topics to discuss will inevitably include the impact of Covid-19 on transfer pricing structures but will also focus on the introduction of BEPS 2.0 and its promise to transform the TP landscape, creating uncertainty around implementation, compliance and mitigating risk. Many taxpayers remain concerned about the potential for controversy, and the importance of understanding methods for preventing and resolving disputes is ever-more crucial. Join the online event to deep-dive into these topics and many more.

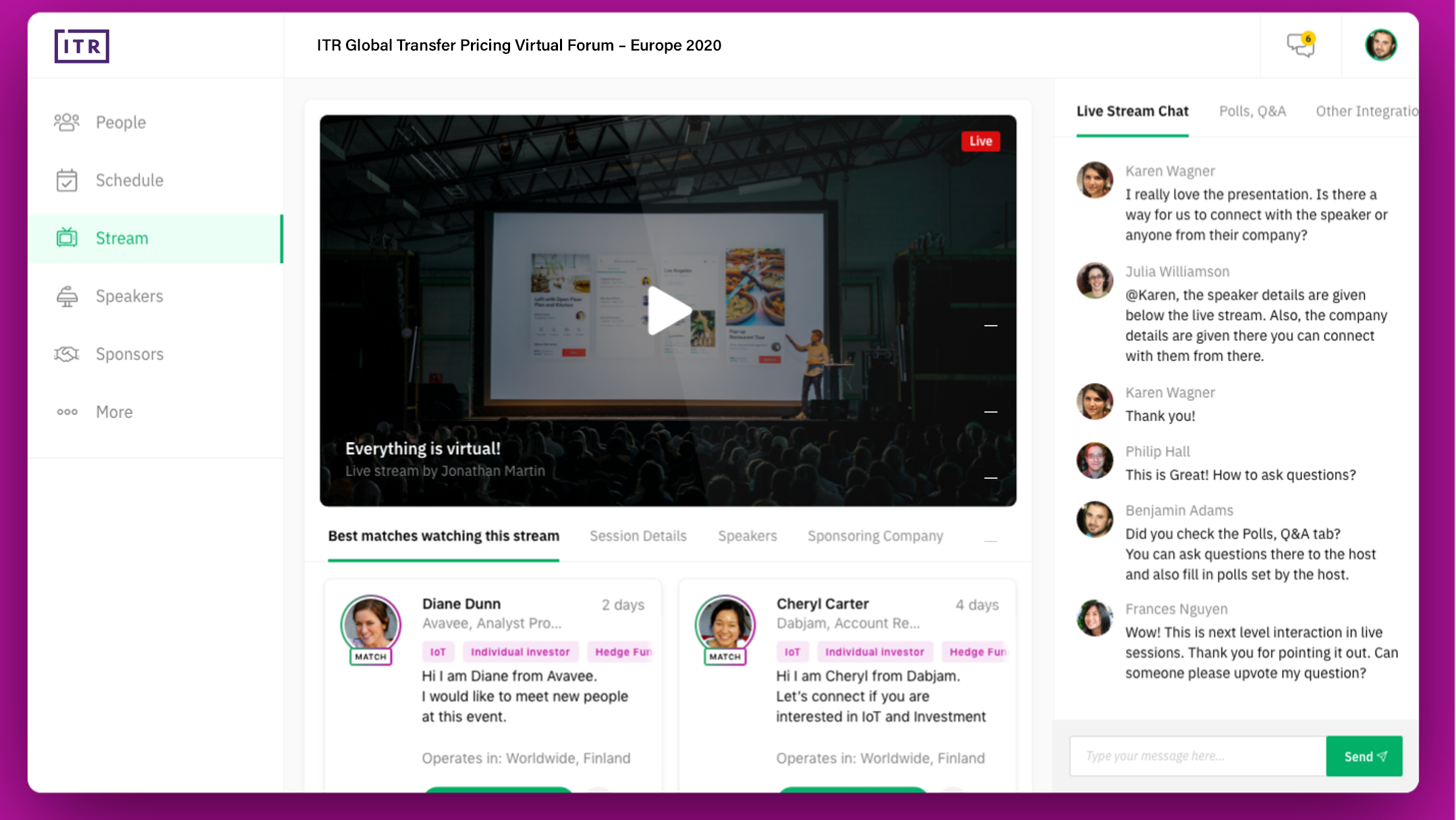

WHAT IS A VIRTUAL FORUM?

Much like an in-person conference, a virtual conference is an online event that brings together top industry experts and industry peers. Through the use of a specially designed events platform, all content, presentations, panel discussions and participation in breakout sessions and networking groups, can be viewed live from a desktop computer or mobile device. You can also view all sessions on demand at a time that suits you.

Valuable networking through AI matchmaking

Our event platform will suggest the best connections for you to meet with based on your profile interests that you input and through AI powered matchmaking. Growing your network with the right people has never been more efficient.

Content on demand

Join live panel discussions, presentations and a variety of digital formats or watch at a more convenient time to suit your needs. Engage with our speakers in live Q&A and polling to get insights and answers to your questions like never before.

Same event, online venue

The online event platform means you can do all the things you would expect at an in-person event. Get full interaction from joining panel discussions with live Q&A and polling, taking part in breakout sessions, and downloading resources. Alternatively, watch all the content at a more convenient time to suit your needs.

SIGN UP ONLINE

Register your place online - sign ups are limited to support several hundred attendees during live sessions.

ACCESS YOUR INVITATION

An exclusive attendance link will be sent to you. This link will provide you with access to all of the event's content and sessions.

WATCH LIVE OR ON DEMAND

Once logged in, you can view all sessions live, at a later date to suit you and can download any available presentation materials.

Keynote addresses, panel discussions, presentations and breakout sessions will be hosted over two days. All session times are in CST unless stated otherwise.

Tuesday, December 1

Opening comments

08.50 - 08.55 CST

OECD keynote address

08.55 - 09.20 CST

Get a review of the current transfer pricing landscape, the progress of implementation of the latest OECD measures and recent COVID-19 guidance.

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Manuel de los Santos Poveda

Adviser – CTPA, OECD

Networking break

09.20 - 09.35 CST

Global transfer pricing review - current landscape and future outlook

09.35 - 10.30 CST

-

Impact of Covid-19 on transfer pricing structures

-

Transfer pricing in a downturn economy

-

Other key regulatory developments

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Marina Gentile

Global transfer pricing lead, Withum (moderator)

Sadia Nazir

director – global transfer pricing, Clarios

Nihan Mert-Beydilli

associate director – transfer pricing, NERA Economic Consulting

Andrew DeSimone

manager – transfer pricing, Withum

Networking break

10.30 - 10.45 CST

Assessing the OECD’s ‘Unified Approach’

10.45 - 11.45 CST

-

What are the benefits? What are the shortcomings?

-

How will the new nexus and profit allocation rules impact multinationals?

-

What measures can be taken to reduce the risk of double taxation?

-

How will disputes be resolved?

Harlow Higinbotham

Managing director, NERA Economic Consulting (moderator)

Joel Wilpitz

Global transfer pricing lead, Kraft Heinz

Manuel de los Santos Poveda

Advisor – CTPA, OECD

Lorraine Eden

Research professor of law and professor emerita of management, Texas A&M University

Niraja Srinivasan

Partner, NERA Economic Consulting

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Networking break

11.45 - 12.00 CST

Transfer pricing implications of US Tax Reform

12.00-12.50 CST

BEAT regulations

How to adapt your transfer pricing structure

How GILTI and FDDI impact transfer pricing arrangements

Has tax reform successfully addressed transfer pricing issues?

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Kathrin Zoeller

AVP tax, transfer pricing, GPL controller, Weatherford (moderator)

Dara Kasouaher

Director of transfer pricing, Mondelez International

Keith Brockman

VP global tax, Welbilt

Lunch and networking

12.50 - 13.45 CST

TP documentation and CbCR

13.45 - 14.45 CST

-

Hear from multinationals on their experiences with documentation and CbCR

-

How is the collected data being used?

-

How to identify gaps in your CbCR filings that may be questioned by multiple tax authorities

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Yoshio Uehara

Partner, Chevez Ruiz Zamarripa (moderator)

Amy Pinson

Senior manager, Bayer

Tosin Akande

Senior vice president – transfer pricing, Citi

Jason Wiegand

Associate director – global transfer pricing, Procter & Gamble

Oscar Campero

Partner, Chevez Ruiz Zamarripa

Networking break

14.45 - 15.00 CST

Jurisdiction focus: LATAM

15.00 - 15.45 CST

Explore the latest transfer pricing developments in Latin America

How are multinationals managing relationships with tax authorities in these jurisdictions?

Assess regional responses to BEPS and what this means for your transfer pricing policy

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Anjana Haines

Managing editor, ITR (moderator)

Flavia Suives

in-house tax director

David Garcia Morales

Head of corporate tax, Geopark

Closing comments and close of day one

15.45 CST

Back to top

Wednesday, December 2

Opening comments

09.15 - 09.20 CST

Transfer pricing of intangibles

09.20 - 10.10 CST

-

Best practice for defining and valuing intangibles

-

Methods for establishing comparability

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Kay Freund

Former director of global transfer pricing, Medtronic (moderator)

Azedine Assassi

Global transfer pricing leader, GE

Jeff Lonard

Manager – transfer pricing, ITW

Networking break

10.10 - 10.25 CST

Financial transactions

10.25 - 11.15 CST

-

What is the latest OECD guidance?

-

Explore the impact of the FTTP on treasury centres and how to deal with unintended consequences of TP rules

-

Understand the issues related to inter-company loans, guarantee transactions and cash pooling

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Andrea Lee

Head of group project, group cost controlling and TP, Erste Bank (moderator)

Bao Ho

Director, transfer pricing, MUFG

Kalale Mambwe

Transfer pricing manager, Zambia Revenue Authority

Networking break

11.15 - 11.30 CST

Operational TP and digitalisation

11.30 - 12.30 CST

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Strategies for building an effective operational TP environment

What needs to change? Where should investment be directed?

How can existing systems be used to overcome data and process issues?

Finding the place for transfer pricing within your wider tax technology plan

Pat Dervin

director of transfer pricing, Aon (moderator)

George Stasny

manager – transfer pricing, Halliburton

Carmen White

Director – tax & trade operations and technology, Microsoft

Michelle Velez

director – tax, ITT

Al Heber

associate director – global transfer pricing, Zimmer Biomet

Lunch and networking

12.30 - 13.30 CST

Dispute avoidance and resolution

13.30 - 14.30 CST

Errol Bong

Head of compliance & legal counsel, Noble Group

Martin Rock

Director M&A, Commerzbank

Peter Wittmann

Managing director, Asia-IO

Eric Xin

Senior managing director, managing partner, private equity, CITIC Capital

Navigating disputes amid a changing controversy landscape

How to capitalise on recent initiatives on dispute prevention

Seeking certainty through APAs

Alternative dispute resolution

Brian Gleicher

Partner, White & Case (moderator)

John Wall

APMA assistant director, IRS

Sue Huang

Associate tax director – transfer pricing, Intel

Nicholas Wilkins

Associate, White & Case

Closing comments

14.30 CST

Back to top

ATTENDEE PROFILE

With more opportunities to connect than ever before, the region's largest meeting of tax professionals is set to welcome a truly global audience.

"The ability to network and speak with so many smart and talented women

"Course content, ability to network and emphasis on woman leaders

"Open discussion among stakeholders with different perspectives: regulators, corporates and advisors

"The substance and speakers were excellent

"Knowledgeable speakers and topics that keep us current.

SPEAKERS

If you feel you have something to contribute or would like to position yourself as an expert in your field, please get in touch with Lucy Huckle for corporate speaking enquiries or Jamil Ahad for tax advisories or service provider opportunities.

Manuel de los Santos Poveda

OECD

Learn more ›

Marina Gentile

Withum

Learn more ›

Harlow Higinbotham

NERA

Learn more ›

Niraja Srinivasan

NERA

Learn more ›

Lorraine Eden

Texas A&M University

Learn more ›

Dara Kasouaher

Mondelez International

Learn more ›

Keith Brockman

Welbilt

Learn more ›

Kathrin Zoeller

Weatherford

Learn more ›

Yoshio Uehara

Chevez Ruiz Zamarripa

Learn more ›

Amy Pinson

Bayer

Learn more ›

Tosin Akande

Citi

Learn more ›

Jason Wiegand

Procter & Gamble

Learn more ›

Sadia Nazir

Clarios

Learn more ›

Oscar Campero

Chevez Ruiz Zamarripa

Learn more ›

Joel Wilpitz

Kraft Heinz

Learn more ›

David Garcia Morales

Geopark

Learn more ›

Azedine Assassi

GE

Learn more ›

Kay Freund

formerly Medtronic

Learn more ›

Jeff Lonard

ITW

Learn more ›

Sanford Stark

Morgan Lewis

Learn more ›

Kalale Mambwe

Zambia Revenue Authority

Learn more ›

Pat Dervin

Aon

Learn more ›

George Stasny

Halliburton

Learn more ›

Carmen White

Microsoft

Learn more ›

Michelle Velez

ITT

Learn more ›

Al Heber

Zimmer Biomet

Learn more ›

Brian Gleicher

White & Case

Learn more ›

John Wall

IRS

Learn more ›

Nicholas Wilkins

White & Case

Learn more ›

Sue Huang

Intel

Learn more ›

Nihan Mert-Beydilli

NERA Economic Consulting

Learn more ›

Flavia Suives

Learn more ›

Bao Ho

MUFG

Learn more ›

Andrea Lee

Erste Bank

Learn more ›

Andrew DeSimone

Withum

Learn more ›

Register your place today

Get access to the ITR Global Transfer Pricing Forum - USA 2020 below. Registration includes:

LIVE DISCUSSIONS

Watch all panel discussions and presentations live

ON DEMAND ACCESS

Watch any of the recorded sessions at a time that suits you

ONLINE NETWORKING

Get access to an exclusive AI-driven networking platform online

TAX EXECUTIVES

Access to all sessions is FREE

-

Tax executives

-

Tax managers

-

Heads of tax

ADVISORS

Access to all sessions is $349

-

Partners and of counsel

-

Associates

-

Tax consultancies